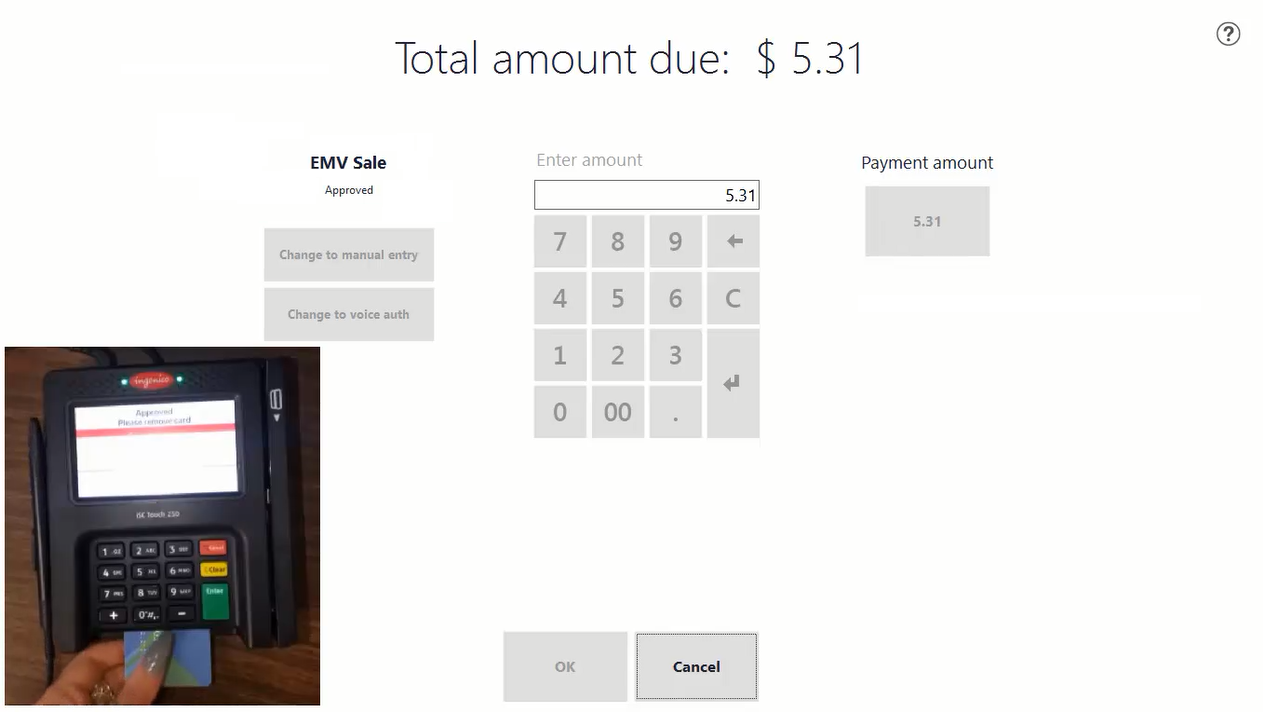

System Solutions has developed a new integration for Microsoft Dynamics 365 For Operations, previously called Microsoft Dynamics AX, which allows users to process EMV chip and pin transactions. The Microsoft Dynamics 365 For Operations (Dynamics AX) EMV Integration allows retailers, wholesalers, and distributors to process various types of EMV transactions, including sales, returns, voids, and more.

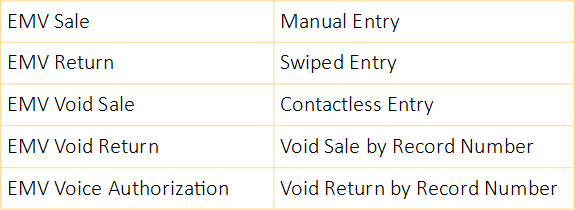

Since 2015, retailers have been changing their method of credit card processing to EMV to comply with regulations. This integration makes it easy for Microsoft Dynamics 365 For Operations users to do the same. More capabilities include:

EMV processing for Microsoft Dynamics 365 For Operations is supported by the following processors: Mercury, first Data, TSYS, Sterling, Worldpay, Heartland, Chase Paymentech, Global Payments, Vantiv, and more.

If you would like to learn more about the Microsoft Dynamics 365 For Operations (Dynamics AX) integration from System Solutions, please read the brochure, watch it in action, or talk to a sales representative by emailing us or calling 860-781-6470.